WHITE PAPER

Top 10 Things to Do

Before Refinancing or Sourcing New Loans

Lenders will be biased against corporate borrowers who appear disorganized and unprepared in their credit request process. This includes even your incumbent bank when considering refinancing or additional financing options. Taking time to compile necessary documents and proper materials before talking to lenders will increase the chances of you receiving a good term sheet and eventually getting to closing. Lenders are more likely to respond quickly and bid aggressively if your information is compiled in such a way to make it easy for them to go to credit committee. Read the top ten things to consider before starting your RFP process.

The white paper includes a checklist for next steps and specific materials to prepare before going to market on your credit request.

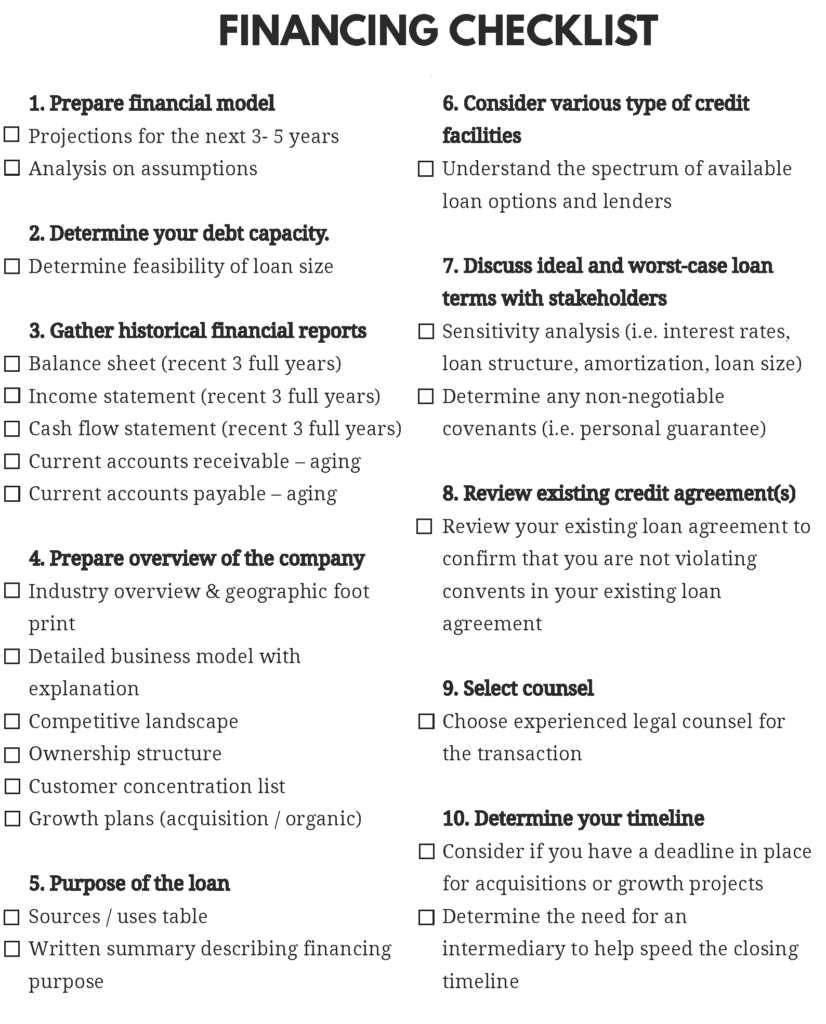

FINANCING CHECKLIST

Know exactly the things you will need to bring to the table prior to engaging with a commercial lender. Be better prepared and better informed to win the best terms for your company.

1. Prepare financial model

Lenders will want to see three to five years of financial projections. Be prepared to explain your inputs and defend your assumptions. Be sure to include the expected impact of the requested financing.

Cerebro can provide term estimates to help you model your projections.

2. Determine debt capacity

Prior to engaging with lenders, determine if your desired loan amount is feasible in today’s market.

Cerebro offers a free and confidential Debt Capacity Calculator to help you understand your company’s borrowing capacity

3. Gather historical financial reports

a. Balance sheet, income statement, and cash flows (3 years)

b. Corresponding tax returns and audited statements are often required

c. Current receivables and payables aging

d. Other items depending on deal structure (equipment listings, real estate

appraisals, inventory agings, various contracts, etc.)

Lenders will request specific details about your business, the industry you are in and how the loan will be used. Be prepared to discuss these areas in-depth with lenders that are reviewing your loan application.

4. Prepare an overview of the business

Your business overview should include at minimum the following information:

a. Industry overview & geography

b. Detailed business model

c. Competitive landscape

d. Ownership structure

e. Customer concentration list

f. Growth plans

5. Loan Purpose

Create a table of the sources and uses of the project or initiative related to the requested financing. Then, prepare a short written summary describing the need and purpose for the financing in the context of how it makes good business value.

Cerebro can help you define your loan narrative.

6. Consider different credit facilities

Different lenders will determine credit worthiness based on variables including cash flow, assets, enterprise value and growth. Some lenders aren’t regulated like traditional banks and therefore can offer very different terms that could be more beneficial to your business.

7. Outline best/worst case scenarios

It is important to run some sensitivity analysis around the interest rate, structure, and loan size. Consider non negotiable covenants. This will allow you to properly evaluate trade offs that the lenders present.

8. Review existing credit agreements

Ensure that sourcing a new loan doesn’t violate any covenants for your existing loans. If you need to review loan covenants, Cerebro’s Compliance Navigator can help.

9. Select counsel

Even though you may have trusted legal counsel for your company, it is important to make sure your counsel has experience with loan financings. If not, it will be very important to select counsel that has experience with the kind of transactions you are pursuing.

10. Determine your timeline

Consider if you have a deadline in place for acquisitions or growth projects. There are many steps in closing a loan and though some loans can close within 3-4 weeks, they often can take closer to 3 months to close. In order to shorten the turnaround time, an intermediary can work with the lenders to ensure a smooth process and closing on time or early.

Cerebro Capital’s commercial loan software is revolutionizing and modernizing the corporate loan process with data-driven technology. A team of financial and software experts combined their shared knowledge to build an all-in-one platform that creates efficient loan sourcing and portfolio management processes for middle market companies, PE firms, and intermediaries. Learn more about what makes Cerebro different.

Ready to get started?

Join the thousands of mid-sized companies who have used Cerebro.

- info@cerebrocapital.com

-

12 W Madison St.

Baltimore, MD 21201 - Cerebro Capital

- @cerebrocapital