Compliance Navigator

Loan Compliance Tracking Software

Adhere to commercial loan covenants with our loan covenant management software.

- Reduce your risk of default

- Replace spreadsheets with a State of the Art solution

- Same time & resources with proven technology

Loan Agreement Management Software

Perfect for companies managing multiple loan agreements and compliance requirements.

Cerebro’s loan compliance software & covenant compliance platform digitizes full loan agreements onto an indexed and searchable platform. Multiple stakeholders including finance teams, lenders, and portfolio managers all benefit from a single repository with user permissions and world class security.

Financial Covenant Analysis

Compute financial ratios and limits per the terms of the agreement to assist with financial analysis and risk management.

Non-Financial Covenant Tracking

Easily track non-financial covenants through clear interactive dashboards. Easily assign loan covenant tasks to internal stakeholders and track event driven loan covenants and notifications automatically.

Covenant Calendar & Reminders

Customize your calendar views and email alerts to ensure all reviewers and SMEs are reporting compliance on time.

Compliance Reporting & Communication

Streamline the creation of compliance certificates and workflow approvals. Send compliance certificates and email alerts to internal and external stakeholders.

Reducing the Risk of Loan Default

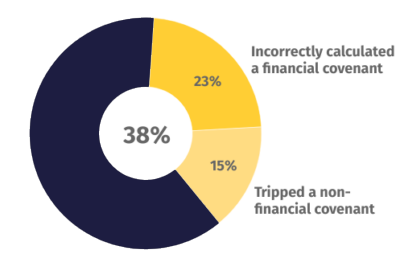

Over 38% of middle market companies violated a loan agreement and didn’t know it. If you are still using Excel spreadsheets and calendar reminders, you may be at risk of a loan default as well as costly amendment fees from your lender.

Save time and avoid additional fees by automating and monitoring your loan compliance with a state-of-the-art loan management software platform. Compliance Navigator is the solution for any company managing credit facilities.

*Based on study of first time Cerebro Compliance Navigator users.

Frequently Asked Questions

How long does it take?

It takes 5 minutes to create an account and drag & drop your loan agreement. All covenants will then be digitized in 24-48 hours.

Can I track multiple loans?

Cerebro’s Compliance Navigator can easily handle multiple loans with different covenant packages. Manage each loan individually or see all your loans on one dashboard.

Who sees my loan information?

Your loan covenants and covenant reports are securely managed within your private account. You can grant access rights to various stakeholders like your counsel or accountants.

How do I update the financial ratios?

You can easily drag & drop your updated financial statements in a matter of minutes. Your updated financials will flow through and instantly calculate your covenants.

How am I notified when a report is due?

You can activate email alerts and reminders 15 and 30 days before a report is due to your lender.

Can my attorney review it?

Yes. Your stakeholders can receive view only, edit or approval rights on any of your compliance reports.

See How Compliance Navigator Works

Schedule a demo with our compliance experts and learn how to:

- Reduce risk of default

- Manage multiple loan agreements

- Learn best practices of compliance management

Cerebro Capital is proud to be SOC 1 Type 1 compliant – verified by Thoropass, meeting AICPA standards.