Loan Products

Financing Options for Mid-Sized Businesses

Discover your lending options and easily secure financing.

Quickly Discover Your Financing Options

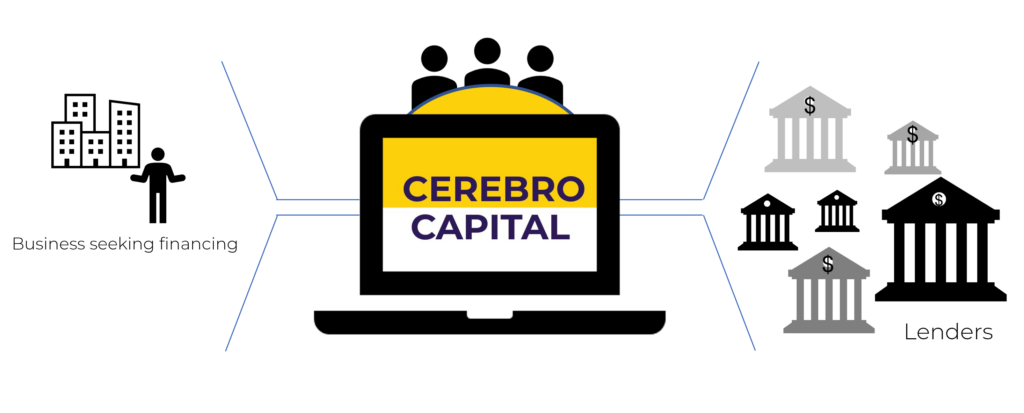

Discover all your business financing options- quickly and easily all in one place. With help from our Capital Markets experts and our data-driven marketplace of over 2,200 banks & lenders, you gain direct access to options that match your unique business story.

The Right Loan for Your Business

Find the right financing options available for your business from our powerful network of banks and lenders. Cerebro provides you tech-enabled lender matching based on your unique situation and our experts are here to help you.

Do you know which commercial loans are right for your company?

We can help. Talk with our experienced team today.

Find your perfect matches from over 2,200 top lenders.

Let Cerebro match you to the right sources for your unique financing needs.

- National Commercial Banks

- Regional & Community Banks

- Asset-Based Lenders

- Non-Bank Lenders

- Mezzanine Funds

- Factors & PO Lenders

- SBICs & BDCs

- Equipment Finance Lenders

- Family Offices

- Private Debt Funds

- Venture Debt

Tap into Cerebro's powerful lender network.

See the Results

*These rates are averages, calculated from current and past Cerebro Capital clients.

Testimonials

“Having access to Cerebro’s targeted group of lenders has given us confidence that we are getting the best deal in the market.”

Co-Founder

Capital Advisory Services

“Thank you! Without Cerebro it would have taken significantly longer to find the right lender.”

CFO

Manufacturing

“Working with Cerebro gave us more leverage and options than just working with our existing lender.”

COO

Travel Technology Industry

Ready to get started?

Join the thousands of mid-sized companies who have used Cerebro.

- info@cerebrocapital.com

-

12 W Madison St.

Baltimore, MD 21201 - Cerebro Capital

- @cerebrocapital