Match to Top Lenders

Smart Business Financing

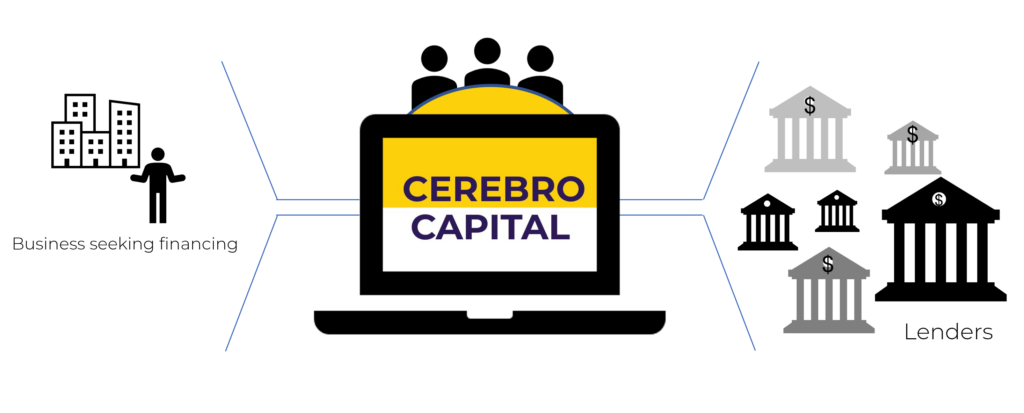

Cerebro’s data-driven marketplace matches you to the exact right loan options from over 2,200 top lenders for your unique financing needs.

For Business Loans

$2 million to $100 million

Just 15 minutes to start.

Smart Financing Powered by Cerebro

Match to Your Best Lenders

Automatically get your best lender matches from 2,200+ top bank and non-bank lenders in our powerful network.

Lower Rates. Better Terms.

Favorable rates & options across various loan structures and lender types.

Fast & Efficient

Tech-enabled lender matching and automated workflows bring efficiency to the lending process.

Find your perfect matches from over 2,200 top lenders.

Let Cerebro match you to the right sources for your unique financing needs.

- National Commercial Banks

- Regional & Community Banks

- Asset-Based Lenders

- Non-Bank Lenders

- Mezzanine Funds

- Factors & PO Lenders

- SBICs & BDCs

- Equipment Finance Lenders

- Family Offices

- Private Debt Funds

- Venture Debt

Tap into Cerebro's powerful lender network.

Powered by Cerebro

$5.6B

committed proposals

$10MM

average loan size

$2MM - $100MM

loan amounts

2,200+

top lenders

The Right Loan for Your Business

Find the right financing options available for your business from our powerful network of banks and lenders. Cerebro provides you tech-enabled lender matching based on your unique situation and our experts are here to help you.

See the Results

*These rates are averages, calculated from current and past Cerebro Capital clients.

Experts in Asset-Based Financing

Just 15 Minutes to Get Started

Start with Cerebro by making a Complimentary Loan Request that gives you a powerful data-driven analysis of your financing options. Your information is completely confidential.

Borrowing Capacity

Get an estimate for your borrowing capacity.

Strengths & Risks

See a data-driven risk score across your financial performance.

Rates & Terms

Learn what rates and terms you can expect in the market.

Lender Matches

Explore the number of interested lenders that are a match for you.

Testimonials

“Having access to Cerebro’s targeted group of lenders has given us confidence that we are getting the best deal in the market.”

Co-Founder

Capital Advisory Services

“Thank you! Without Cerebro it would have taken significantly longer to find the right lender.”

CFO

Manufacturing

“Working with Cerebro gave us more leverage and options than just working with our existing lender.”

COO

Travel Technology Industry

Ready to get started?

Join the thousands of mid-sized companies who have used Cerebro.

- info@cerebrocapital.com

-

12 W Madison St.

Baltimore, MD 21201 - Cerebro Capital

- @cerebrocapital